4QFY2017 Result Update | IT

May 31, 2017

Tech Mahindra

BUY

CMP

`388

Performance Highlights

Target Price

`533

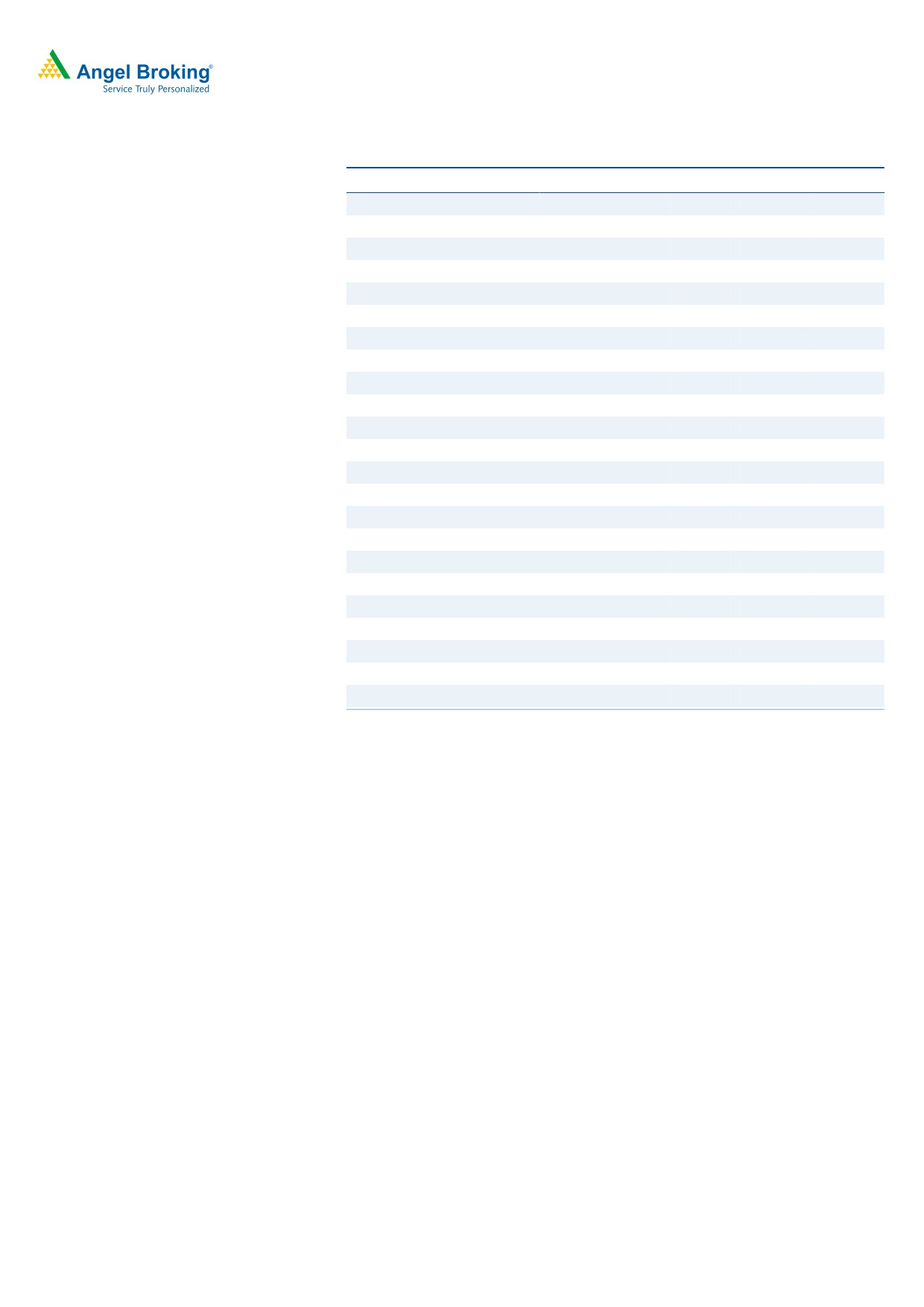

(` cr)

4QFY17

3QFY17

% chg (QoQ)

4QFY16

% chg (YoY)

Investment Period

12 Months

Net revenue

7,495

7,558

(0.8)

6,884

8.9

EBITDA

899

1,187

(24.3)

1,162

(22.7)

Stock Info

EBITDA margin (%)

12.0

15.7

(371)bps

16.9

(489)bps

Sector

IT

Adj. PAT

588

845

(30.4)

897

(34.5)

Market Cap (` cr)

37,809

Source: Company, Angel Research;

Net Debt (` cr)

(4395)

Tech Mahindra posted muted set of numbers for 4QFY2017. For the quarter,

Beta

1.1

sales came in at US$1,131mn v/s 1,129mn expected, registering a qoq growth of

52 Week High / Low

564/358

1.3%. In Rupee terms, the sales came in at `7,495cr v/s `7,533cr expected, a

Avg. Daily Volume

2,12,936

qoq de-growth of 0.8%. In Constant Currency (CC) terms, the company posted a

Face Value (`)

5

0.9% qoq growth during the quarter. On, the operating front, a 4.2% qoq rise in

BSE Sensex

31,159

the cost of revenues resulted in the EBDITA and EBIT margins coming at 12.0%

Nifty

9,625

and 8.2% v/s 15.5% and 12.2% expected respectively, qoq dip of 371 bps and

Reuters Code

TEML.BO

421 bps. Thus, the Adj. net profit came in at `588cr v/s `741cr expected, qoq

Bloomberg Code

TECHM@IN

dip of 30.4%. We maintain our Buy rating on the stock.

Result highlights: For the quarter, sales came in at US$1,131mn v/s 1,129mn

expected, registering a qoq growth of 1.3%. In Constant Currency (CC) terms, the

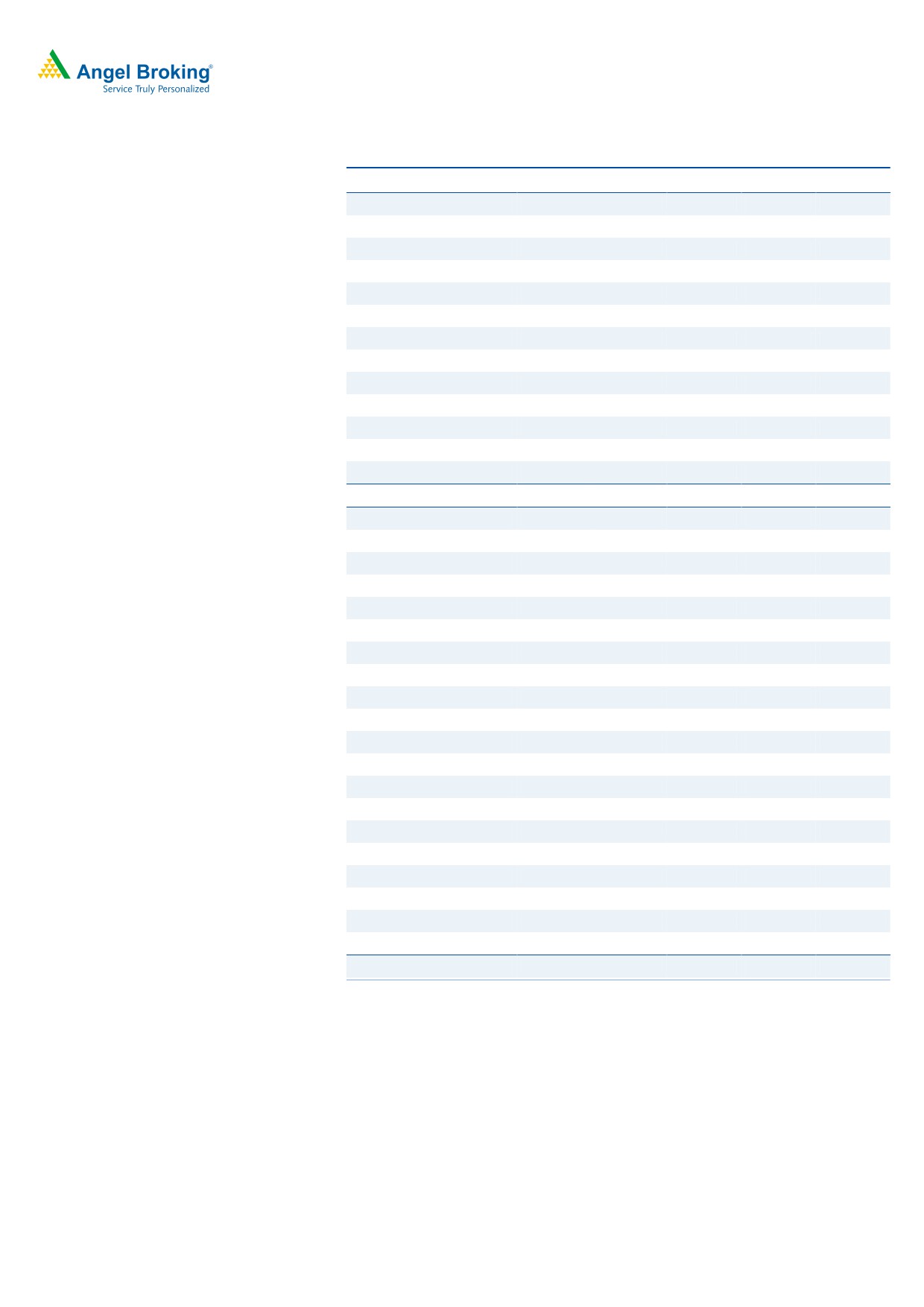

Shareholding Pattern (%)

company posted a 0.9% qoq growth during the quarter. In terms of geography,

Promoters

36.2

USA was a major dampener; it constituted 45.1% of sales v/s 46.7% of sales in

MF / Banks / Indian Fls

15.5

3QFY2016; while ROW was the key driver, constituting 25.3% of sales v/s 23.9%

FII / NRIs / OCBs

37.7

of sales in 3QFY2016. On, the operating front, a 4.2% qoq rise in the cost of

Indian Public / Others

10.6

revenues, resulted in the EBDITA and EBIT margins coming at 12.0% and 8.2%

v/s 15.5% and 12.2% expected respectively, qoq dip of 371 bps and 421 bps.

Thus, the Adj. net profit came in at `588cr v/s `741cr expected qoq dip of

Abs.(%)

3m 1yr

3yr

30.4%.

Sensex

8.4

16.6

28.7

Outlook and valuation: We expect a CAGR of 8.0% and 7.2% in USD and INR

Tech Mahindra

(22.4)

(28.7)

(19.0)

revenue respectively over FY2017-19E. The PAT is expected to grow at a

CAGR of 8.6% over FY2017-19E. We maintain our Buy rating on the stock with

a Target Price of `533.

3-year price chart

800

Key financials (Consolidated, Indian GAAP)

700

Y/E March (` cr)

FY2016

FY2017

FY2018E

FY2019E

600

500

Net sales

26,494

29,141

31,015

33,496

400

% chg

17.1

10.0

6.4

8.0

300

Net profit

3,118

2,813

3,102

3,315

200

% chg

18.7

(9.8)

10.3

6.9

100

0

EBITDA margin (%)

16.3

14.4

15.0

15.0

EPS (`)

35.8

32.3

35.6

38.1

P/E (x)

10.8

12.0

10.9

10.2

Source: Company, Angel Research

P/BV (x)

2.3

2.1

1.9

1.7

RoE (%)

21.4

17.1

17.0

16.3

RoCE (%)

20.1

15.6

16.1

15.9

EV/Sales (x)

1.3

1.2

1.1

1.0

Sarabjit kour Nangra

EV/EBITDA (x)

8.1

8.6

7.6

7.0

+91 22 3935 7800 Ext: 6806

Source: Company, Angel Research; Note: CMP as of May 30, 2017

Please refer to important disclosures at the end of this report

1

Tech Mahindra | 4QFY2017 Result Update

Exhibit 1: 4QFY2017 performance (Consolidated, Indian GAAP)

(` cr)

4QFY17

3QFY17

% chg (qoq)

4QFY16

% chg (yoy)

FY17

FY16

% chg (yoy)

Net revenue

7,558

7,167

5.4

6,701

12.8

21,646

19,611

10.4

Cost of revenue

5,235

4,972

5.3

4,607

13.6

14,103

13,058

8.0

Gross profit

2,322

2,196

5.8

2,094

10.9

7,543

6,553

15.1

SG&A expense

1,136

1,126

0.9

959

18.4

4,258

3,433

24.0

EBITDA

1,187

1,070

10.9

1,135

4.5

3,286

3,120

5.3

Dep. and amortization

248

245

1.3

174

42.5

695

542

28.2

EBIT

939

825

13.7

962

(2.4)

2,591

2,579

0.5

Interest

35

35

1.2

24

99.3

97

63

53.7

Other income

155

139

11.9

64

59.0

540

284

90.0

PBT

1,059

930

13.9

1,002

5.7

3,034

2,800

8.4

Income taxes

214

286

(25.1)

233

12.4

747

638

17.1

PAT

845

644

31.2

769

9.8

2,287

2,162

5.8

Minority interest

0

(0)

-

10

(98.5)

-

1

PAT after minority interest

845

644

31.2

759

11.2

2,285

2,162

5.7

Profit from associates

-

-

-

-

-

Exceptional item

-

-

-

-

-

Reported PAT

845

644

31.2

759

11.2

2,285

2,162

5.7

Adj. PAT

845

645

31.0

759

11.2

2,285

2,162

5.7

Diluted EPS

8.8

6.7

31.0

7.9

11.2

23.8

22.5

5.7

Gross margin (%)

30.7

30.6

9bp

31.2

(52)bps

34.8

33.4

143bp

EBITDA margin (%)

15.7

14.9

77bp

16.9

(124)bps

15.2

15.9

(73)bp

EBIT margin (%)

12.4

11.5

90bp

14.4

(194bps

12.0

13.1

(118)bp

PAT margin (%)

11.3

9.0

233bps

11.3

0bps

10.6

11.0

(47)bp

Source: Company, Angel Research

Exhibit 2: 4QFY2017 - Actual Vs Angel estimates

(` cr)

Actual

Estimate

% Var

Net revenue

7,495

7,533

(0.5)

EBITDA margin (%)

12.0

15.5

350bps

PAT

588

741

(20.6)

Source: Company, Angel Research

Revenue growth led by ROW

For the quarter, sales came in at US$1,131mn v/s 1,129mn expected, registering

a qoq growth of 1.3%. In Rupee terms, the sales came in at `7,495cr v/s `7,533cr

expected, a qoq de-growth of 0.8%. In Constant Currency (CC) terms, the

company posted a 0.9% qoq growth during the quarter.

In terms of geography, USA was a major dampener, it constituted 45.1% of sales

v/s 46.7% of sales in 3QFY2016 posting a qoq growth of 2.1%; while ROW was

the key driver constituting 25.3% of sales v/s 23.9% of sales in 3QFY2016, posting

a qoq growth of 7.3%. Europe, on the other hand posted a qoq growth of 2.1%.

In terms of the industries, the manufacturing came in at 19.2% of sales v/s

18.4% of sales in 3QFY2016, posting a qoq growth of 5.8%. BFSI was the main

driver, which lead the segment to contribute around 14.1% of sales v/s 13.1% of

sales in 3QFY2016, posting a qoq growth of 9.9%. The key domain i.e. Retail,

Transport & Logistics, posted a qoq de-growth of 13.3%. Also, Technology,

Media & Entertainment, posted a qoq de-growth of 1.8%.

May 30, 2017

2

Tech Mahindra | 4QFY2017 Result Update

Revenue growth during the quarter was a function of strength in the core

Telecom business, planned cut-down of the Network business and unexpected

deferral of VAS products.

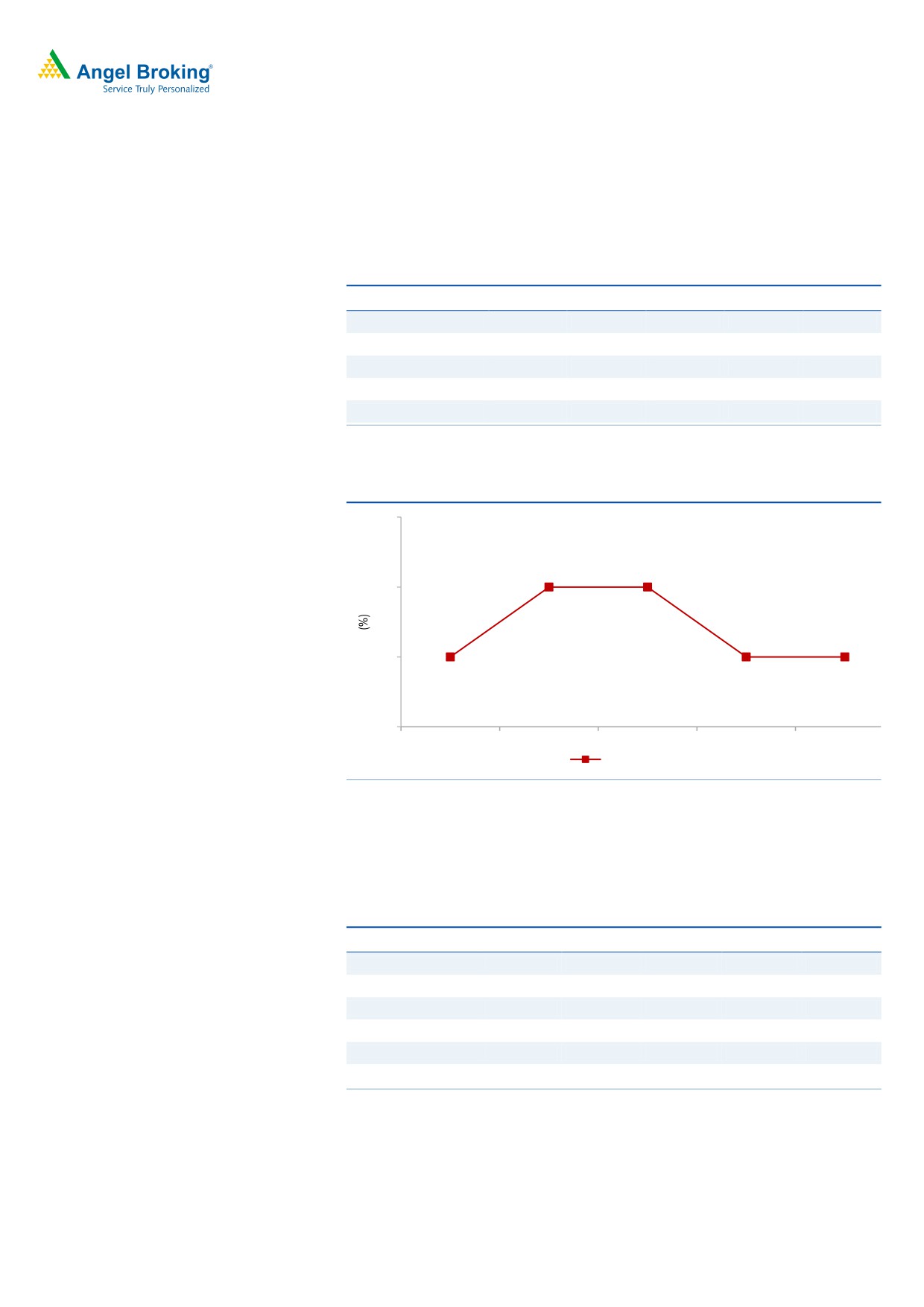

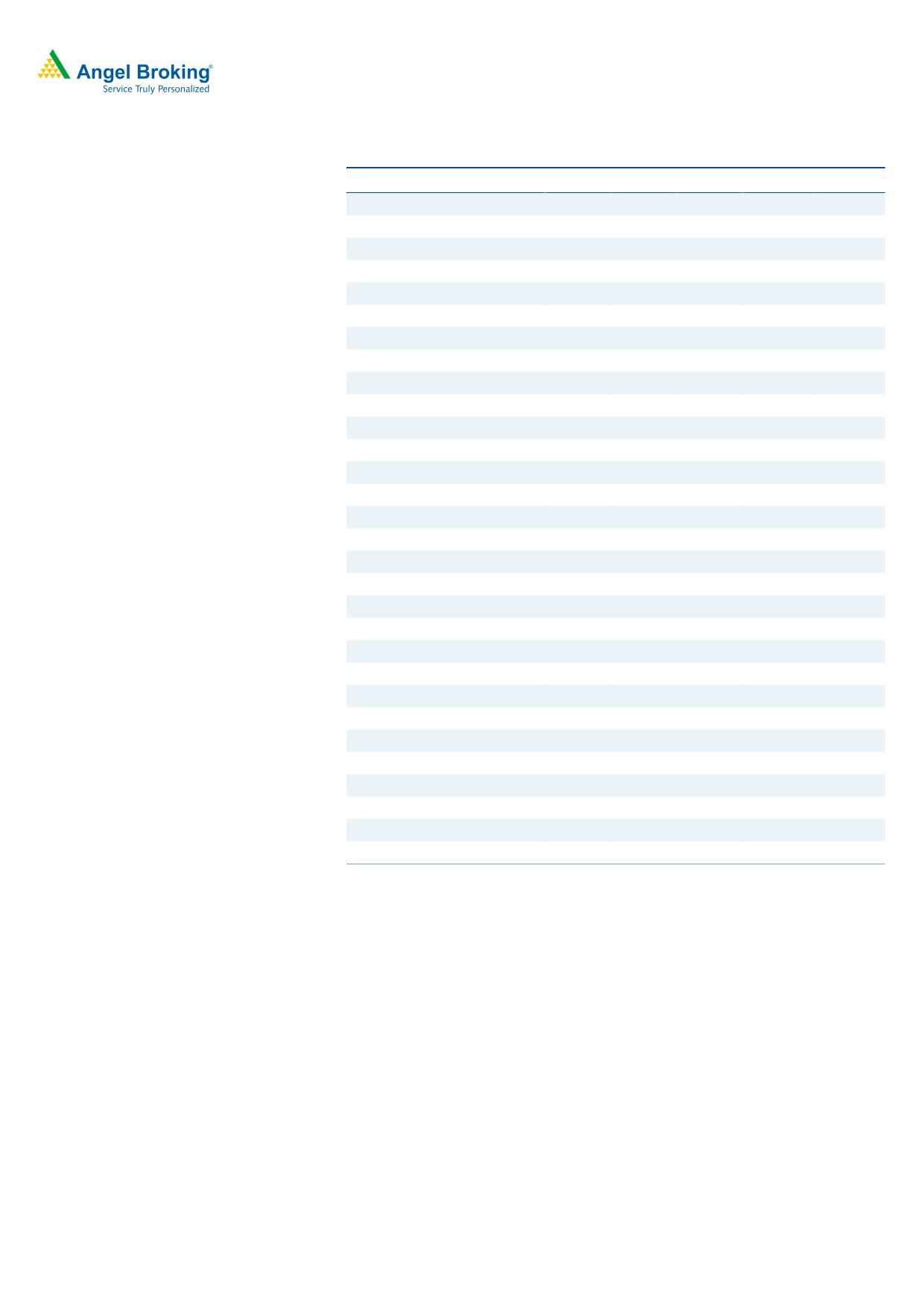

Exhibit 3: Trend in revenue growth

4.0%

4.1%

1140.0

9.0%

1120.0

8.0%

7.0%

1100.0

0.9%

6.0%

1080.0

0.8%

5.0%

1060.0

0.4%

4.0%

1040.0

3.0%

1020.0

2.0%

1000.0

1.0%

980.0

0.0%

960.0

-1.0%

4QFY16

1QFY17

2QFY17

3QFY17

4QFY17

Sales ( in US $mn)

qoq (%)

Source: Company, Angel Research

Exhibit 4: Growth in industry segments

Particulars

% to revenue

% growth (QoQ)

% growth (YoY)

Telecom

46.0

0.5

0.6

Manufacturing

19.2

5.8

24.2

TME

6.2

(1.8)

(8.6)

BFSI

14.1

9.1

47.1

RTL

6.5

(13.3)

16.0

Others

7.7

9.9

10.6

Source: Company, Angel Research

In terms of geographies, ROW posted a growth of 7.3% qoq, while Europe and US

posted a growth of 2.1% and (2.1)% qoq respectively.

Exhibit 5: Growth trend in geographies

Particulars

% to revenue

% growth (QoQ)

% growth (YoY)

Americas

45.1

(2.1)

6.6

Europe

29.6

2.1

14.9

RoW

25.3

7.3

13.3

Source: Company, Angel Research

May 30, 2017

3

Tech Mahindra | 4QFY2017 Result Update

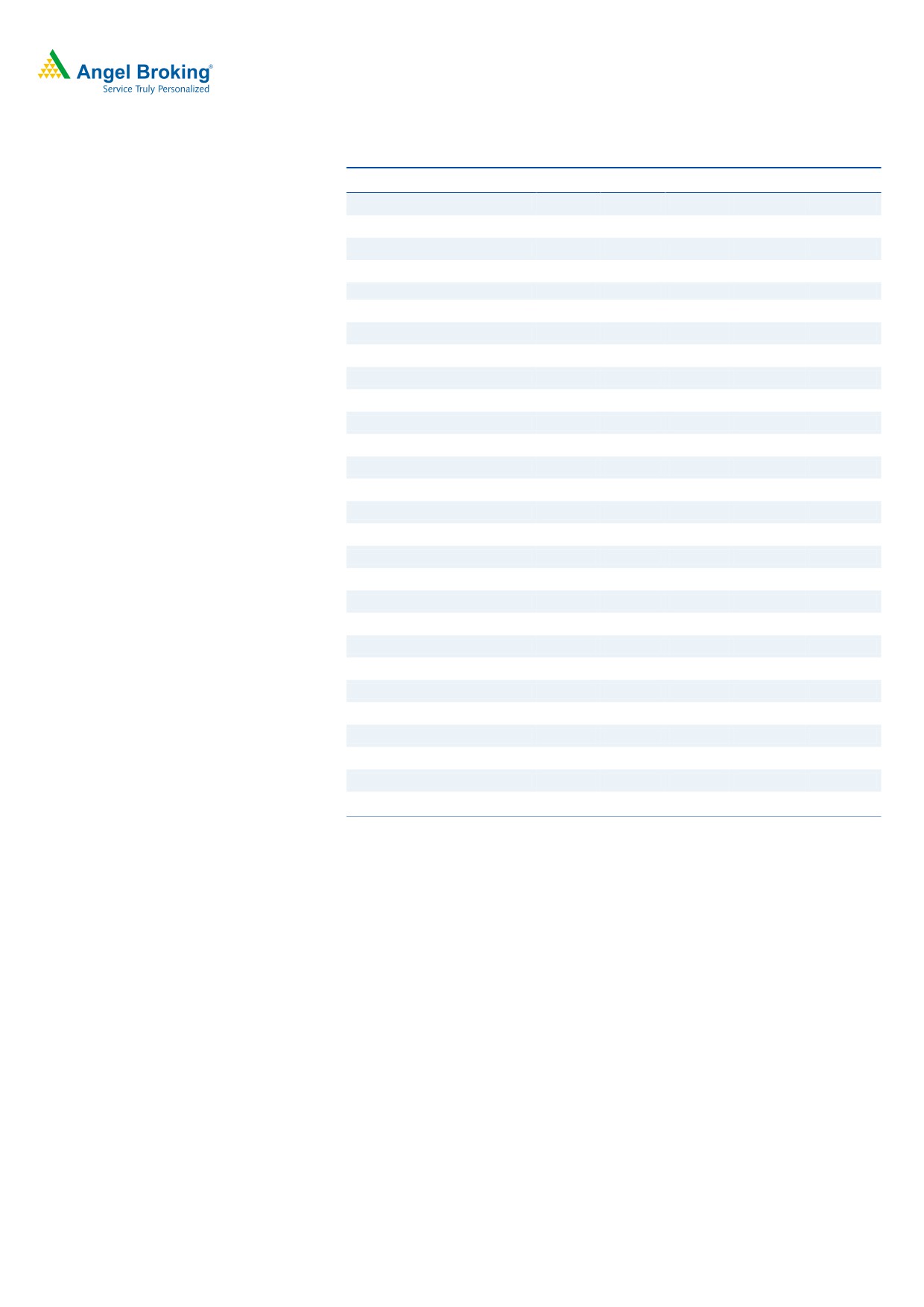

Hiring and client metrics

During the quarter, the company reported a net addition of 598 employees, taking

its overall headcount to 117,693. The BPO headcount currently stands at 28,414

and was the only division to witness additions. Attrition (on LTM basis) was at 17%.

Exhibit 6: Employee metrics

Particulars

4QFY16

1QFY17

2QFY17

3QFY17

4QFY17

Software professionals

72,125

73,590

78,404

80,858

82,403

BPO professionals

27,254

27,326

27,669

29,372

28,414

Sales & support

6,053

6,300

6,813

6,865

6,876

Total employees

105,432

107,216

112,886

117,095

117,693

Attritions (%)

21

21

19

18

17

Source: Company, Angel Research

Exhibit 7: Trend in utilization rate

79

78

78

78

77

77

77

77

76

4QFY16

1QFY17

2QFY17

3QFY17

4QFY17

Utilization (%)

Source: Company, Angel Research

The company added 6 new clients during the quarter, taking the active client base

to 843 (v/s 837 in 3QFY2017), with 8 clients added in US$10mn-20mn+ bracket

and other additions mainly in the US$5mn-10mn+ bracket.

Exhibit 8: Client metrics

Particulars

4QFY16

1QFY17

2QFY17

3QFY17

4QFY17

Total active clients

801

807

818

837

843

US$1mn-5mn

221

207

197

228

220

US$5mn-10mn

42

49

56

63

63

US$10mn-20mn

26

23

22

27

35

US$20mn-50mn

23

26

28

24

22

US$50mn+

14

14

14

14

14

Source: Company, Angel Research

May 30, 2017

4

Tech Mahindra | 4QFY2017 Result Update

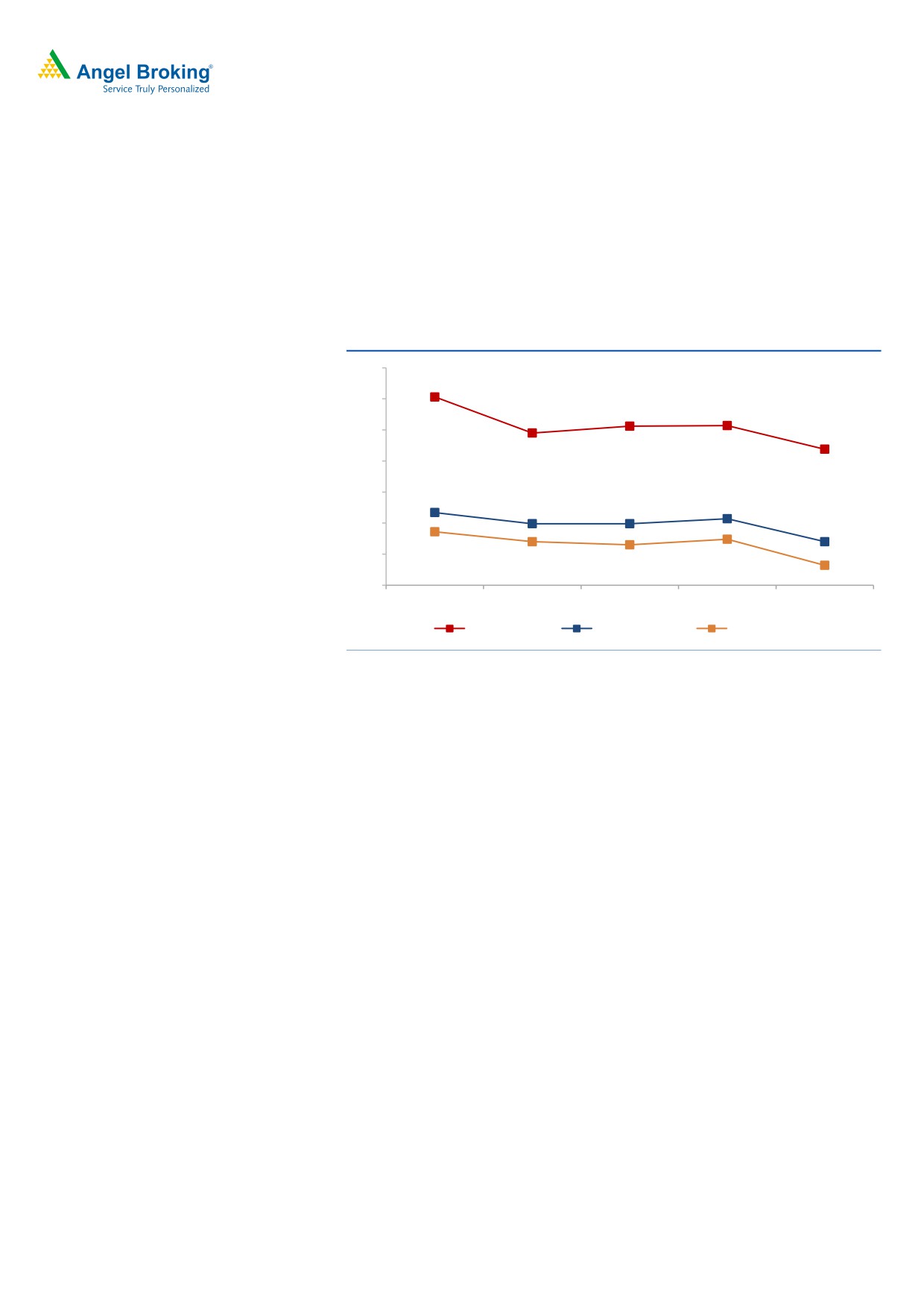

Operating margin dips

On EBIT front, the company posted EBIT of 8.2% (12.2% expected) v/s 12.4% in

3QFY2017. In 4QFY2017, costs included a one-time expense associated with the

restructuring in LCC, impacting margins by 200 bps. This is expected to reverse in

the next quarter. The company was also hit by 150 bps on profitability because of

a pricing reset in a few contracts. This is expected to revive only gradually over the

coming quarters.

Exhibit 9: Margin trend (%)

40

35

35.3

30

30.6

30.7

29.5

25

26.9

20

16.7

15.7

14.9

14.9

15

12.0

10

13.6

12.0

12.4

11.5

5

8.2

4QFY16

1QFY17

2QFY17

3QFY17

4QFY17

Gross margin

EBITDA margin

EBIT margin

Source: Company, Angel Research

Investment arguments

Growth prospects decent: The Management is more optimistic as compared to

what it was at the same time last year. It has also been optimistic about the

prospects of recently acquired entities. On Margin front, the company faces the

usual 1QFY2018 headwinds of visa expenses and Comviva margin contraction.

Any improvement, on the back of synergies and productivity gains will only start

reflecting from 2QFY2018. We expect a CAGR of 8.0% and 7.2% in USD and INR

revenue respectively over FY2017-19E. On EBIT front, we expect the EBIT to be

around 15.0% v/s 14.4% in FY2017.

Inorganic growth initiatives to augment well for company: The company has been

active in the M&A space, with it having acquired Satyam a few years back, to

acquiring LCC and Softgen recently. Softgen’s and LCC’s acquisition was

consolidated in 4QFY2015. LCC is one of the world’s largest independent global

providers of network engineering services to the telecommunications industry with

an estimated annual revenues of more than US$400mn (CY2014) (the effective

run-rate for the business is pruned down to US$200-220mn annualized), with

workforce of over 5,700 network professionals across five continents and more

than 50 countries. With this acquisition, Tech Mahindra will also be addressing a

rapidly growing market opportunity, as telecommunications companies and

enterprises accelerate their network upgrade cycle.

May 30, 2017

5

Tech Mahindra | 4QFY2017 Result Update

Outlook and valuation

Given the recent acquisitions and healthy order pipeline, the company is expected

to post a healthy US$ and INR CAGR of 8.0% and 7.2% respectively over FY2017-

19E. However, the acquisition of LCC will be margin dilutive in the near term,

leading the FY2017 EBDITA margin to drop to 14.4% from 16.3% in FY2016. The

company, given its success in turnaround of its earlier acquisition (Satyam),

believes it would be able to do the same with the recent acquisitions and would be

able to get close to achieving the 20% EBIT levels in future. Given the favorable

valuation on EV/sales front, where it trades at a significant discount to its peers, we

believe the stock should witness uptrend once the profitability returns to its mean

average. We maintain a Buy rating on the stock.

Exhibit 10: Key assumptions

FY2018E

FY2019E

Revenue growth (US$)

8.0

8.0

USD-INR rate (realized)

66.7

66.7

Revenue growth (`)

6.4

8.0

EBITDA margin (%)

15.0

15.0

Tax rate (%)

26.0

26.0

EPS growth (%)

10.3

6.9

Source: Company, Angel Research

Exhibit 11: One-year forward PE (x)

800

600

400

200

0

Price

20

17

14

11

8

Source: Company, Angel Research. Note: P/E includes profits of Mahindra Satyam from FY2012

May 30, 2017

6

Tech Mahindra | 4QFY2017 Result Update

Exhibit 12: Recommendation summary

Company

Reco

CMP

Tgt Price

Upside

FY2019E

FY2019E

FY2017-19E

FY2019E

FY2019E

(`)

(`)

(%)

EBITDA (%)

P/E (x)

EPS CAGR (%)

EV/Sales (x)

RoE (%)

HCL Tech

Buy

867

1,014

17.0

20.9

12.8

6.2

1.8

20.6

Infosys

Buy

996

1,179

18.3

26.0

14.4

5.3

2.3

19.6

TCS

Neutral

2,552

-

-

27.6

16.4

7.8

3.2

29.8

Tech Mahindra

Buy

388

533

37.4

15.0

10.2

8.6

1.0

16.3

Wipro

Accumulate

535

570

6.5

20.3

14.0

4.4

1.3

13.4

Source: Company, Angel Research.

Company Background

Tech Mahindra was founded in 1986 as a joint venture between Mahindra Group

and British Telecom (BT) to service the latter. Later on, the company started

servicing other external clients as well (solely in the telecom industry). In June

2009, Tech Mahindra acquired a 42.7% stake in erstwhile Satyam Computers

(now Mahindra Satyam) and now the latter is entirely merged with the company.

The company has recently acquired the companies - LCC and Softgen. These two

acquisitions have been consolidated in 4QFY2015. LCC is one of the world’s

largest independent global providers of network engineering services to the

telecommunications industry. LCC is estimated to have annual revenues of more

than US$400mn (CY2014), with workforce of over 5,700 network professionals

across five continents and more than 50 countries.

May 30, 2017

7

Tech Mahindra | 4QFY2017 Result Update

Profit and loss statement (Consolidated, Indian GAAP)

Y/E March (` cr)

FY2015

FY2016

FY2017

FY2018E

FY2019E

Net sales

22,621

26,494

29,141

31,015

33,496

Cost of revenues

15,920

18,323

20,566

21,400

23,112

Gross profit

6,701

8,172

8,575

9,615

10,384

% of net sales

29.6

30.8

29.4

31.0

31.0

SG&A expenses

2,549

3,853

4,390

4,962

5,359

% of net sales

11.3

14.5

15.1

16.0

16.0

EBITDA

4,153

4,318

4,184

4,652

5,024

% of net sales

18.4

16.3

14.4

15.0

15.0

Depreciation and amortization

611

762

978

1054

1139

% of net sales

2.7

2.9

3.4

3.4

3.4

EBIT

3,541

3,556

3,206

3,598

3,886

% of net sales

15.7

13.4

11.0

11.6

11.6

Interest expense

30

96

129

129

129

Other inc., net of forex gain/(loss)

106

557

778

778

778

Profit before tax

3,618

4,017

3,855

4,247

4,535

Provision for tax

960

860

1,002

1,104

1,179

% of PBT

26.5

21.4

26.0

26.0

26.0

PAT

2,659

3,157

2,853

3,143

3,356

Exceptional item

-

-

-

-

-

Minority interest

31

44

40

40

40

Reported PAT

2,628

3,118

2,813

3,102

3,315

Adjusted PAT

2,628

3,118

2,813

3,102

3,315

Fully diluted EPS (`)

30.2

35.8

32.3

35.6

38.1

May 30, 2017

8

Tech Mahindra | 4QFY2017 Result Update

Balance sheet (Consolidated, Indian GAAP)

Y/E March (` cr)

FY2015

FY2016

FY2017

FY2018E

FY2019E

Equity capital

480

436

439

439

439

Preference capital

-

-

-

-

-

Share premium

-

-

-

-

-

Profit and loss

11,768

14,155

15,998

17,823

19,861

Other reserves

0

0

0

-

-

Net worth

12,249

14,591

16,438

18,261

20,300

Secured loans

621

1,002

1,219

1,219

1,219

Unsecured loans

54

-

-

-

-

Total debt

675

1,002

1,219

1,219

1,219

Other long term liability

376

147

537

537

537

Long-term provisions

414

531

620

620

620

Minority interest

160

193

464

504

545

Amount pending investigation

895

1,230

1,230

1,230

1,230

Total capital employed

14,768

17,695

20,508

22,372

24,451

Gross block

7,811

7,973

11,677

12,677

13,677

Accumulated dep.

(3,477)

(4,239)

(5,217)

(6,272)

(7,410)

Net block

4,334

4,364

6,460

6,406

6,267

Capital WIP

266

629

373

373

373

Total fixed assets

4,601

4,993

6,833

6,778

6,640

Investments

2,103

1,243

2,396

4,483

6,736

Long term loans and adv.

1,306

1,895

2,435

2,696

3,117

Interest in TML benefit trust

-

-

-

-

-

Deferred tax asset, net

390

532

267

267

267

Other non-current assets

-

0

0

-

-

Inventories

24

40

61

61

61

Sundry debtors

5,206

5,770

5,338

7,980

7,981

Cash and cash equv.

2,405

4,018

3,219

3,500

4,000

Loans and advances

3,813

4,032

5,518

2,999

3,000

Current investments

-

-

-

-

-

Unbilled revenue

-

-

-

-

-

Sundry creditors

(1,654)

(2,276)

(2,312)

(2,658)

(3,057)

Other liabilities

(1,627)

(2,200)

(2,860)

(3,289)

(3,782)

Provision

(1,799)

(355)

(387)

(445)

(512)

Working capital

6,368

9,031

8,577

8,148

7,691

Total capital deployed

14,768

17,695

20,508

22,372

24,451

May 30, 2017

9

Tech Mahindra | 4QFY2017 Result Update

Cash flow statement (Consolidated, Indian GAAP)

Y/E March (` cr)

FY2015

FY2016

FY2017

FY2018E FY2019E

Pre tax profit from operations

2,659

3,157

2,853

3,143

3,356

Depreciation

611

762

978

1,054

1,139

Exp. (deffered)/written off/others

-

-

-

-

-

Pre tax cash from operations

3,270

3,919

3,831

4,197

4,494

Other income/prior period ad

106

557

778

778

778

Net cash from operations

3,376

4,475

4,609

4,975

5,272

Tax

(960)

(860)

(1,002)

(1,104)

(1,179)

Cash profits

2,417

3,615

3,607

3,871

4,093

(Inc)/dec in

Sundry Debtors

(857)

(565)

433

(2,642)

(1)

Inventories

(15)

(16)

(21)

-

-

Loans and advances

(1,197)

(219)

(1,485)

2,519

(1)

Sundry creditors

105

621

36

347

399

Others

212

573

660

429

493

Net trade working capital

(1,752)

394

(377)

652

890

Cashflow from operating activities

665

4,010

3,230

4,523

4,983

(Inc)/dec in fixed assets

(1,740)

(393)

(1,840)

54

139

(Inc)/dec in investments

(2,067)

860

(1,153)

(2,087)

(2,253)

(Inc)/dec in other non current assets

16

(0)

0

0

-

Cashflow from investing activities

(3,791)

467

(2,992)

(2,033)

(2,114)

Inc/(dec) in debt

(311)

(328)

(217)

-

-

Inc/(dec) in deferred revenue

-

-

-

-

1

Inc/(dec) in equity/premium

1

-

-

0

-

Inc/(dec) in minority interest

(16)

(33)

(271)

(40)

(40)

Dividends

(611)

(1,223)

(917)

(1,278)

(1,277)

Others

1,713

(1,281)

369

(891)

(1,054)

Cashflow from financing activities

775

(2,864)

(1,037)

(2,209)

(2,369)

Cash generated/(utilised)

(2,351)

1,613

(800)

281

500

Cash at start of the year

4,756

2,405

4,018

3,219

3,500

Cash at end of the year

2405

4018

3219

3500

4000

May 30, 2017

10

Tech Mahindra | 4QFY2017 Result Update

Key Ratios

Y/E March

FY2015

FY2016

FY2017

FY2018E

FY2019E

Valuation ratio (x)

P/E (on FDEPS)

12.9

10.8

12.0

10.9

10.2

P/CEPS

10.4

8.7

8.9

8.1

7.6

P/BVPS

2.8

2.3

2.1

1.9

1.7

Dividend yield (%)

1.3

3.1

3.1

3.1

3.4

EV/Sales

1.6

1.3

1.2

1.1

1.0

EV/EBITDA

8.7

8.1

8.6

7.6

7.0

EV/Total assets

7.8

7.0

5.2

5.2

5.3

Per share data (`)

EPS

30.2

35.8

32.3

35.6

38.1

Cash EPS

37.2

44.5

43.5

47.7

51.1

Dividend

5.0

12.0

12.0

12.0

13.0

Book value

140.6

167.5

188.7

209.6

233.0

Dupont analysis

Tax retention ratio (PAT/PBT)

0.7

0.8

0.7

0.7

0.7

Cost of debt (PBT/EBIT)

1.0

1.1

1.2

1.2

1.2

EBIT margin (EBIT/Sales)

0.2

0.1

0.1

0.1

0.1

Asset turnover ratio (Sales/Assets)

4.9

5.3

4.3

4.6

5.0

Leverage ratio (Assets/Equity)

0.4

0.3

0.4

0.4

0.3

Operating ROE (%)

21.5

21.4

17.1

17.0

16.3

Return ratios (%)

RoCE (pre-tax)

24.0

20.1

15.6

16.1

15.9

Angel RoIC

29.3

27.3

19.0

19.4

19.4

RoE

21.5

21.4

17.1

17.0

16.3

Turnover ratios( x)

Asset turnover (fixed assets)

4.9

5.3

4.3

4.6

5.0

Receivables days

92

86

70

97

90

Payable days

29

34

30

32

35

May 30, 2017

11

Tech Mahindra | 4QFY2017 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Tech Mahindra

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

May 30, 2017

12